In his TASC February 2023 article, John Ehlers proposed to use the average of open and close, rather than the close price, for technical indicators. The advantage is a certain amount of noise reduction. On intraday bars the open-close average is similar to an SMA(2). It makes the data a bit smoother, but at cost of additional lag by half a bar.

The script below, in C for the Zorro platform, compares the standard RSI with the open-close average RSI on the S&P 500 index with 15-minute bars:

void run()

{

BarPeriod = 15;

StartDate = 20220629;

EndDate = 20220712;

asset("SPX500");

vars OC = series((priceO()+priceC())/2);

plot("RSI(Close)",RSI(seriesC(),14),NEW,RED);

plot("RSI(OC)",RSI(OC,14),0,BLUE);

}

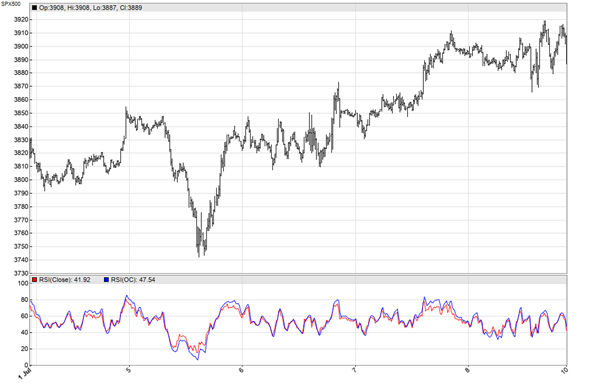

We can indeed see some noise reduction in the resulting chart:

The obvious question: Will the smoother curve compensate for the additional lag in a trading system? For testing this, I added the following 5 lines to the script:

vars RSIs = series(RSI(OC,14)); if(crossUnder(RSIs,70)) enterShort(); if(crossOver(RSIs,30)) enterLong();

That’s a simple RSI trading system: Enter a short position when the RSI crosses below 70, and enter a long position when it crosses above 30. Any position is closed when an opposite position is opened. I found indeed that that using the open-close average produced a better result with some instruments and time periods, but a worse result with others. There was no clear tendency. However, it’s certainly worth a try when you’re anyway developing an indicator based trading system.

The script can be downloaded from the 2023 script repository.

On first quick attempts – not finding a good use for this.