Trading systems come in two flavors: model-based and data-mining. This article deals with model based strategies. Even when the basic algorithms are not complex, properly developing them has its difficulties and pitfalls (otherwise anyone would be doing it). A significant market inefficiency gives a system only a relatively small edge. Any little mistake can turn a winning strategy into a losing one. And you will not necessarily notice this in the backtest. Continue reading “Build Better Strategies! Part 2: Model-Based Systems”

Tag: Market Meanness Index

Boosting Strategies with MMI

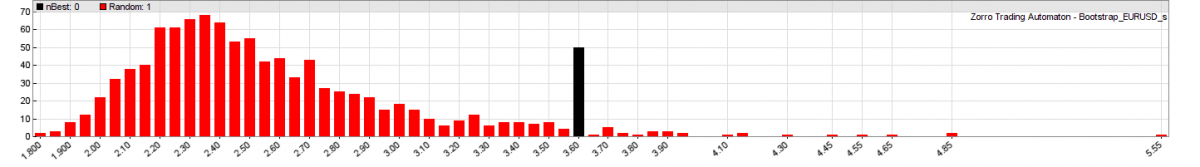

We will now repeat our experiment with the 900 trend trading strategies, but this time with trades filtered by the Market Meanness Index. In our first experiment we found many profitable strategies, some even with high profit factors, but none of them passed White’s Reality Check. So they all would probably fail in real trading in spite of their great results in the backtest. This time we hope that the MMI improves most systems by filtering out trades in non-trending market situations. Continue reading “Boosting Strategies with MMI”

The Market Meanness Index

This indicator can improve – sometimes even double – the profit expectancy of trend following systems. The Market Meanness Index tells whether the market is currently moving in or out of a “trending” regime. It can this way prevent losses by false signals of trend indicators. It is a purely statistical algorithm and not based on volatility, trends, or cycles of the price curve. Continue reading “The Market Meanness Index”