About 9 out of 10 backtests produce wrong or misleading results. This is the number one reason why carefully developed algorithmic trading systems often fail in live trading. Even with out-of-sample data and even with cross-validation or walk-forward analysis, backtest results are often way off to the optimistic side. The majority of trading systems with a positive backtest are in fact unprofitable. In this article I’ll discuss the cause of this phenomenon, and how to fix it. Continue reading “Why 90% of Backtests Fail”

Category: System Evaluation

More Robust Strategies

The previous article dealt with John Ehlers’ AM and FM demodulating technology for separating signal and noise in price curves. In the S&C June issue he described a practical example. Applying his FM demodulator makes a strategy noticeably more robust – at least with parameter optimization.

Detecting Volume Breakouts

It is estimated that about 6000 different technical indicators have been meanwhile published, but few of them are based on volume. In his article in Stocks & Commodities April 2021, Markos Katsanos proposed a new indicator for detecting high-volume breakouts. And he tested it with a trading system that I believe is the most complex one ever posted on this blog.

The Trend Persistence Indicator

Financial markets are not stationary: Price curves swing all the time between trending, mean reverting, or entirely random behavior. Without a filter for detecting trend regime, any trend following strategy will bite the dust sooner or later. In Stocks & Commodities February 2021, Richard Poster proposed a trend persistence indicator for avoiding unprofitable market periods.

“Please Send Me a Trading System!”

“It should produce 150 pips per week. With the best indicators that you know. How much does it cost? Please also send live histories of your top systems.”

Although we often get such requests, we still don’t know the best indicators and can’t send live histories. We do not invent algo trading systems, but program them from clients’ specifications. And we do not trade them, except for testing. But after almost 1000 systems, we can see a pattern emerging. Which algo trading strategies do usually work? Which will fall apart already in the backtest? Here’s a ranking of all systems we did so far, with a surprising winner. Continue reading ““Please Send Me a Trading System!””

The Scholz Brake: Fixing Germany’s New 1000% Trader Tax

Would you like to read – from begin to end – a 18 page pounderous law draft titled “Law for introducing a duty to report cross-border tax structuring”? The members of the German Bundestag apparently didn’t. After all, nothing seemed wrong with a duty to report cum-ex schemes. So the new law, proposed by finance minister Olaf Scholz, passed legislation on December 12, 2019 without much discussion. Only afterwards its real content, hidden on page 15, became public. It caused incredulity and turmoil among traders and investors. This article deals with the new bizarre German ‘trader tax’, and with ways to step around it. Continue reading “The Scholz Brake: Fixing Germany’s New 1000% Trader Tax”

Hacking a HFT system

Compared with machine learning or signal processing algorithms of conventional algo trading strategies, High Frequency Trading systems can be surprisingly simple. They need not attempt to predict future prices. They know the future prices already. Or rather, they know the prices that lie in the future for other, slower market participants. Recently we got some contracts for simulating HFT systems in order to determine their potential profit and maximum latency. This article is about testing HFT systems the hacker’s way. Continue reading “Hacking a HFT system”

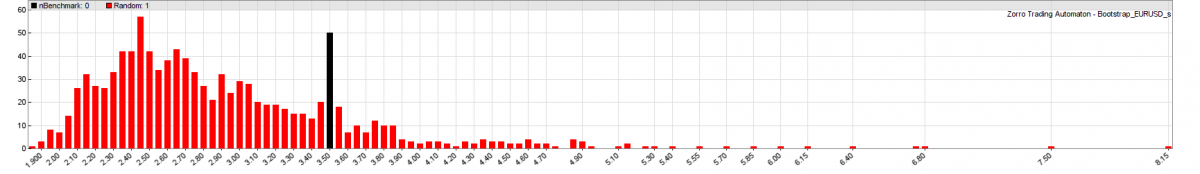

Better Tests with Oversampling

The more data you use for testing or training your strategy, the less bias will affect the test result and the more accurate will be the training. The problem: price data is always in short supply. Even shorter when you must put aside some part for out-of-sample tests. Extending the test or training period far into the past is not always a solution. The markets of the 1990s or 1980s were very different from today, so their price data can cause misleading results.

In this article I’ll describe a simple method to produce more trades for testing, training, and optimizing from the same amount of price data. The method is tested with a price action system based on data mining price patterns. Continue reading “Better Tests with Oversampling”

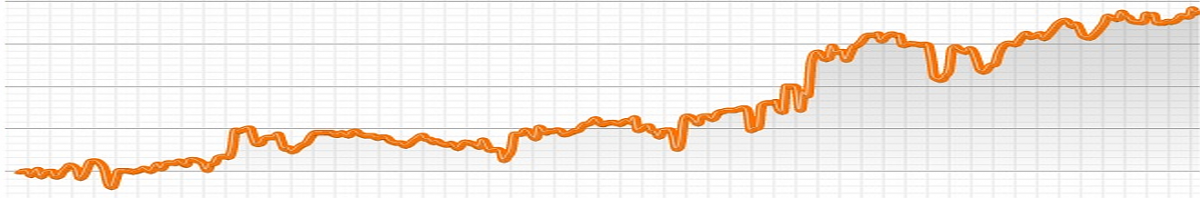

The Cold Blood Index

You’ve developed a new trading system. All tests produced impressive results. So you started it live. And are down by $2000 after 2 months. Or you have a strategy that worked for 2 years, but revently went into a seemingly endless drawdown. Situations are all too familiar to any algo trader. What now? Carry on in cold blood, or pull the brakes in panic?

Several reasons can cause a strategy to lose money right from the start. It can be already expired since the market inefficiency disappeared. Or the system is worthless and the test falsified by some bias that survived all reality checks. Or it’s a normal drawdown that you just have to sit out. In this article I propose an algorithm for deciding very early whether or not to abandon a system in such a situation. Continue reading “The Cold Blood Index”

Is “Scalping” Irrational?

Clients often ask for strategies that trade on very short time frames. Some are possibly inspired by “I just made $2000 in 5 minutes” stories on trader forums. Others have heard of High Frequency Trading: the higher the frequency, the better must be the trading! The Zorro developers had been pestered for years until they finally implemented tick histories and millisecond time frames. Totally useless features? Or has short term algo trading indeed some quantifiable advantages? An experiment for looking into that matter produced a surprising result. Continue reading “Is “Scalping” Irrational?”