About 9 out of 10 backtests produce wrong or misleading results. This is the number one reason why carefully developed algorithmic trading systems often fail in live trading. Even with out-of-sample data and even with cross-validation or walk-forward analysis, backtest results are often way off to the optimistic side. The majority of trading systems with a positive backtest are in fact unprofitable. In this article I’ll discuss the cause of this phenomenon, and how to fix it. Continue reading “Why 90% of Backtests Fail”

Tag: White’s reality check

Boosting Strategies with MMI

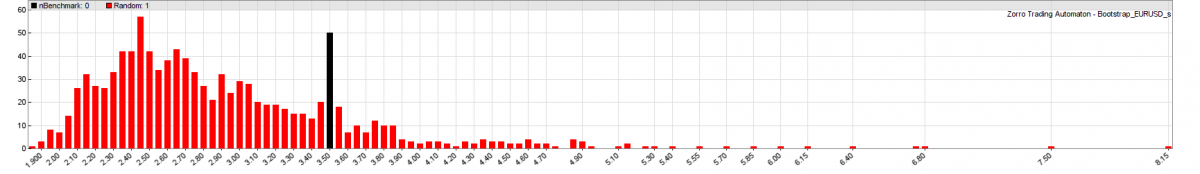

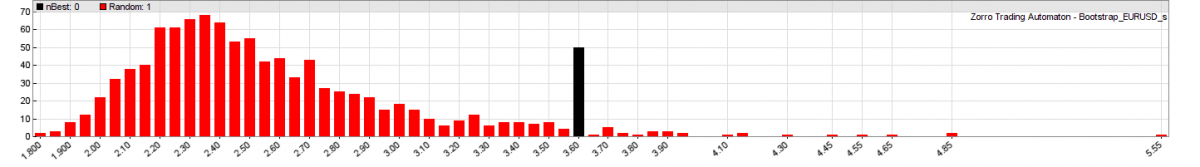

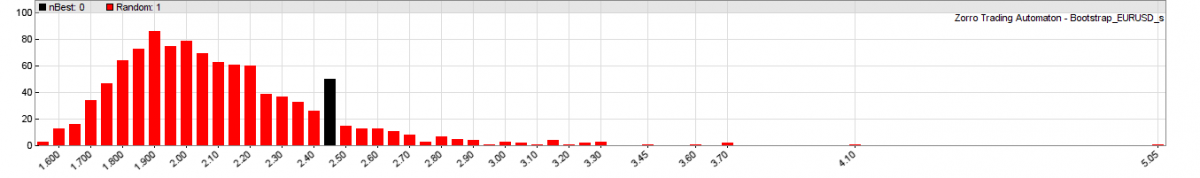

We will now repeat our experiment with the 900 trend trading strategies, but this time with trades filtered by the Market Meanness Index. In our first experiment we found many profitable strategies, some even with high profit factors, but none of them passed White’s Reality Check. So they all would probably fail in real trading in spite of their great results in the backtest. This time we hope that the MMI improves most systems by filtering out trades in non-trending market situations. Continue reading “Boosting Strategies with MMI”

White’s Reality Check

This is the third part of the Trend Experiment article series. We now want to evaluate if the positive results from the 900 tested trend following strategies are for real, or just caused by Data Mining Bias. But what is Data Mining Bias, after all? And what is this ominous White’s Reality Check? Continue reading “White’s Reality Check”