“It should produce 150 pips per week. With the best indicators that you know. How much does it cost? Please also send live histories of your top systems.”

Although we often get such requests, we still don’t know the best indicators and can’t send live histories. We do not invent algo trading systems, but program them from clients’ specifications. And we do not trade them, except for testing. But after almost 1000 systems, we can see a pattern emerging. Which algo trading strategies do usually work? Which will fall apart already in the backtest? Here’s a ranking of all systems we did so far, with a surprising winner. Continue reading ““Please Send Me a Trading System!””

Category: Research

Better Strategies 5: A Short-Term Machine Learning System

It’s time for the 5th and final part of the Build Better Strategies series. In part 3 we’ve discussed the development process of a model-based system, and consequently we’ll conclude the series with developing a data-mining system. The principles of data mining and machine learning have been the topic of part 4. For our short-term trading example we’ll use a deep learning algorithm, a stacked autoencoder, but it will work in the same way with many other machine learning algorithms. With today’s software tools, only about 20 lines of code are needed for a machine learning strategy. I’ll try to explain all steps in detail. Continue reading “Better Strategies 5: A Short-Term Machine Learning System”

Is “Scalping” Irrational?

Clients often ask for strategies that trade on very short time frames. Some are possibly inspired by “I just made $2000 in 5 minutes” stories on trader forums. Others have heard of High Frequency Trading: the higher the frequency, the better must be the trading! The Zorro developers had been pestered for years until they finally implemented tick histories and millisecond time frames. Totally useless features? Or has short term algo trading indeed some quantifiable advantages? An experiment for looking into that matter produced a surprising result. Continue reading “Is “Scalping” Irrational?”

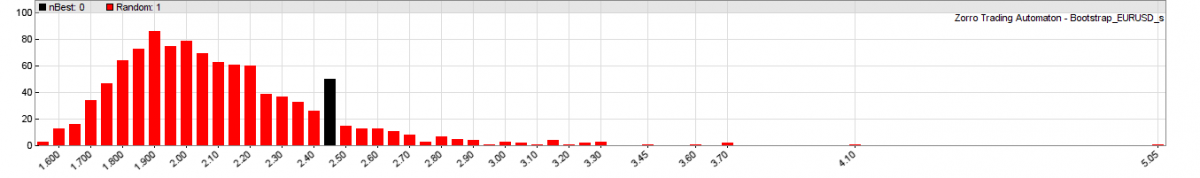

White’s Reality Check

This is the third part of the Trend Experiment article series. We now want to evaluate if the positive results from the 900 tested trend following strategies are for real, or just caused by Data Mining Bias. But what is Data Mining Bias, after all? And what is this ominous White’s Reality Check? Continue reading “White’s Reality Check”

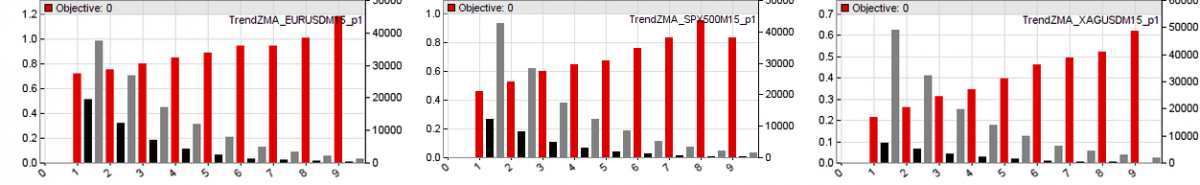

The Trend Experiment

This is the second part of the trend experiment article series, involving 900 systems and 10 different “smoothing” or “low-lag” indicators for finding out if trend really exists and can be exploited by a simple algorithmic system. When you do such an experiment, you have normally some expectations about the outcome, such as: Continue reading “The Trend Experiment”