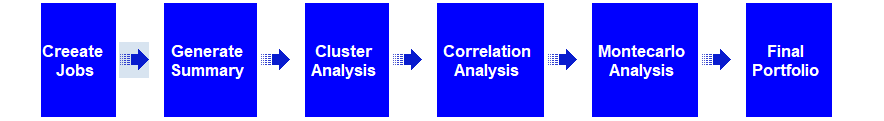

Developing a successful strategy is a process with many steps, described in the Build Better Strategies article series. At some point you have coded a first, raw version of the strategy. At that stage you’re usually experimenting with different functions for market detection or trade signals. The problem: How can you determine which indicator, filter, or machine learning method works best with which markets and which time frames? Manually testing all combinations is very time consuming, close to impossible. Here’s a way to run that process automated with a single mouse click. Continue reading “Build Better Strategies, Part 6: Evaluation”

Tag: Indicator

The Cybernetic Oscillator

Oscillator-type indicators swing around the zero line. They are often used for opening positions when oscillator exceeds a positive or negative threshold. In his article series about no-lag indicators, John Ehlers presents in the TASC June issue the Cybernetic Oscillator. It is built by applying a highpass and afterwards a lowpass filter to the price curve, then normalizing the result.

Ehlers’ Ultimate Oscillator

In his TASC article series about no-lag indicators, John Ehlers presented last month the Ultimate Oscillator. What’s so ultimate about it? Unlike other oscillators, it is supposed to indicate the current market direction with almost no lag. Continue reading “Ehlers’ Ultimate Oscillator”

The Linear Regression-Adjusted Exponential Moving Average

There are already uncounted variants of moving averages. Vitali Apirine invented another one in his article in the Stocks&Commodities September issue. The LREMA is an EMA with a variable period derived from the distance of the current price and a linear regression line. This ensures an optimal EMA period at any point – at least in theory. Will this complex EMA variant beat the standard EMA for detecting trend changes?

Continue reading “The Linear Regression-Adjusted Exponential Moving Average”

Petra on Programming: Short-Term Candle Patterns

Japanese rice merchants invented candle patterns in the eighteenth century. Some traders believe that those patterns are still valid today. But alas, it seems no one yet got rich with them. Still, trading book authors are all the time praising patterns and inventing new ones, in hope to find one pattern that is really superior to randomly entering positions. In the Stocks & Commodities January 2021 issue, Perry Kaufman presented several new candle patterns. Let’s repeat his pattern tests with major US stocks and indices, and with or without an additional trend filter. Continue reading “Petra on Programming: Short-Term Candle Patterns”

Petra on Programming: The Smoothed OBV

In his article in the S&C April 2020 issue, Vitali Apirine proposed a modified On Balance Volume indicator (OBVM). The hope was that OBVM crossovers and divergences make great trade signals, especially for stock indices. I got the job to put that to the test.