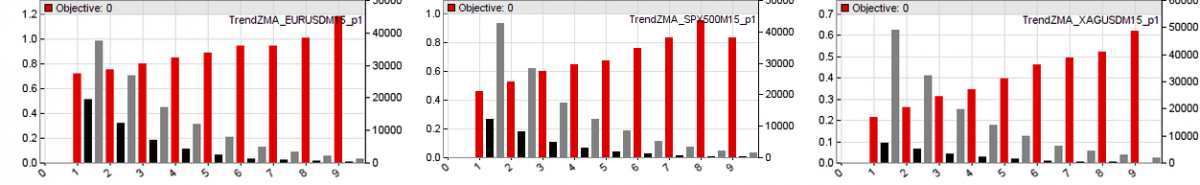

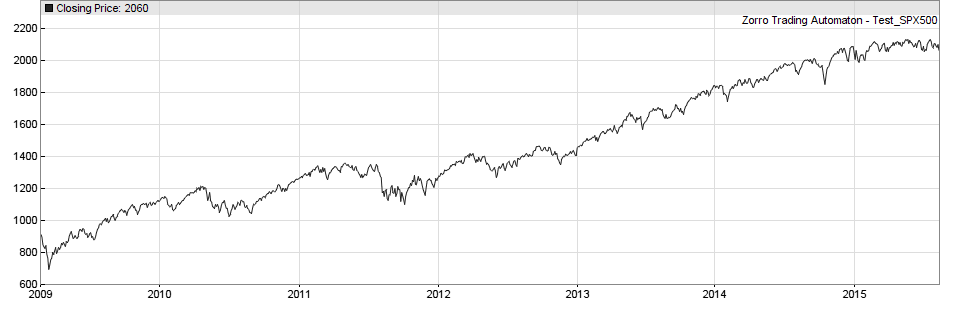

This is the second part of the trend experiment article series, involving 900 systems and 10 different “smoothing” or “low-lag” indicators for finding out if trend really exists and can be exploited by a simple algorithmic system. When you do such an experiment, you have normally some expectations about the outcome, such as: Continue reading “The Trend Experiment”

Author: jcl

Trend Indicators

The most common trade method is ‘going with the trend‘. While it’s not completely clear how one can go with the trend without knowing it beforehand, most traders believe that ‘trend’ exists and can be exploited. ‘Trend’ is supposed to manifest itself in price curves as a sort of momentum or inertia that continues a price movement once it started. This inertia effect does not appear in random walk curves. Continue reading “Trend Indicators”

Money and How to Get It

Contrary to popular belief, money is no material good. It is created out of nothing by banks lending it. Therefore, for each newly created lot of money there’s the same amount of debt. You’re destroying the money by repaying your credits. Since this requires a higher sum due to interest and compound interest, and since money is also permanently withdrawn from circulation by hoarding, the entire money supply must constantly grow. It must never shrink. If it still does, as in the 1930 economic crisis, loan defaults, bank crashes and bankruptcies are the result. The monetary system is therefore a classic Ponzi scheme. Continue reading “Money and How to Get It”