Clients often ask for strategies that trade on very short time frames. Some are possibly inspired by “I just made $2000 in 5 minutes” stories on trader forums. Others have heard of High Frequency Trading: the higher the frequency, the better must be the trading! The Zorro developers had been pestered for years until they finally implemented tick histories and millisecond time frames. Totally useless features? Or has short term algo trading indeed some quantifiable advantages? An experiment for looking into that matter produced a surprising result. Continue reading “Is “Scalping” Irrational?”

Category: Indicators

Boosting Strategies with MMI

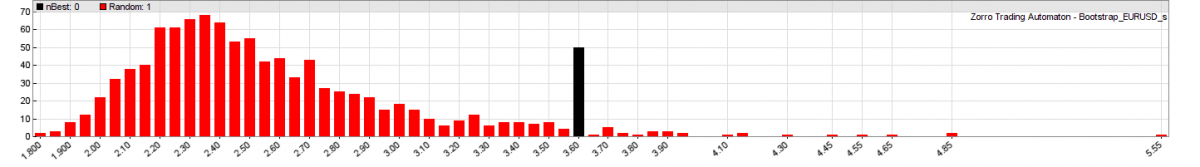

We will now repeat our experiment with the 900 trend trading strategies, but this time with trades filtered by the Market Meanness Index. In our first experiment we found many profitable strategies, some even with high profit factors, but none of them passed White’s Reality Check. So they all would probably fail in real trading in spite of their great results in the backtest. This time we hope that the MMI improves most systems by filtering out trades in non-trending market situations. Continue reading “Boosting Strategies with MMI”

The Market Meanness Index

This indicator can improve – sometimes even double – the profit expectancy of trend following systems. The Market Meanness Index tells whether the market is currently moving in or out of a “trending” regime. It can this way prevent losses by false signals of trend indicators. It is a purely statistical algorithm and not based on volatility, trends, or cycles of the price curve. Continue reading “The Market Meanness Index”

Seventeen Trade Methods That I Don’t Really Understand

When I started with technical trading, I felt like entering the medieval alchemist scene. A multitude of bizarre trade methods and hundreds of technical indicators and lucky candle patterns promised glimpses into the future, if only of financial assets. I wondered – if a single one of them would really work, why would you need all the rest? And how can you foretell tomorrow’s price by drawing circles, angles, bats or butterflies on a chart? Continue reading “Seventeen Trade Methods That I Don’t Really Understand”

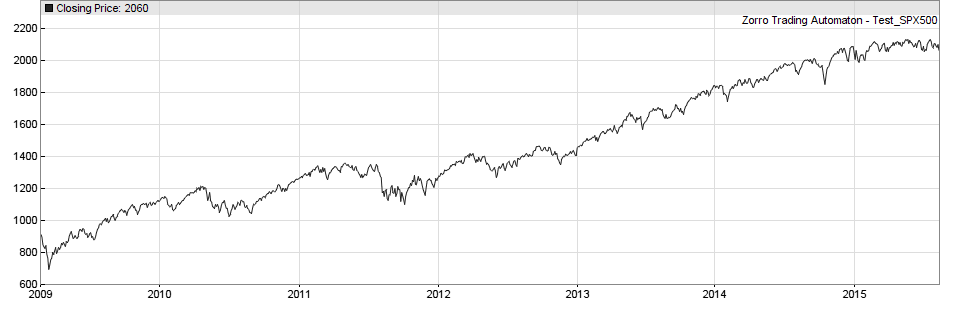

Trend Indicators

The most common trade method is ‘going with the trend‘. While it’s not completely clear how one can go with the trend without knowing it beforehand, most traders believe that ‘trend’ exists and can be exploited. ‘Trend’ is supposed to manifest itself in price curves as a sort of momentum or inertia that continues a price movement once it started. This inertia effect does not appear in random walk curves. Continue reading “Trend Indicators”