Most trading systems are of the get-rich-quick type. They exploit temporary market inefficiencies and aim for annual returns in the 100% area. They require regular supervision and adaption to market conditions, and still have a limited lifetime. Their expiration is often accompanied by large losses. But what if you’ve nevertheless collected some handsome gains, and now want to park them in a more safe haven? Put the money under the pillow? Take it into the bank? Give it to a hedge funds? Obviously, all that goes against an algo trader’s honor code. Here’s an alternative. Continue reading “Get Rich Slowly”

Category: System Development

Binary Options: Scam or Opportunity?

We’re recently getting more and more contracts for coding binary option strategies. Which gives us a slightly bad conscience, since those options are widely understood as a scheme to separate naive traders from their money. And their brokers make indeed no good impression at first look. Some are regulated in Cyprus under a fake address, others are not regulated at all. They spread fabricated stories about huge profits with robots or EAs. They are said to manipulate their price curves for preventing you from winning. And if you still do, some refuse to pay out, and eventually disappear without a trace (but with your money). That’s the stories you hear about binary options brokers. Are binary options nothing but scam? Or do they offer a hidden opportunity that even their brokers are often not aware of? Continue reading “Binary Options: Scam or Opportunity?”

Better Strategies 4: Machine Learning

Deep Blue was the first computer that won a chess world championship. That was 1996, and it took 20 years until another program, AlphaGo, could defeat the best human Go player. Deep Blue was a model based system with hardwired chess rules. AlphaGo is a data-mining system, a deep neural network trained with thousands of Go games. Not improved hardware, but a breakthrough in software was essential for the step from beating top Chess players to beating top Go players.

In this 4th part of the mini-series we’ll look into the data mining approach for developing trading strategies. This method does not care about market mechanisms. It just scans price curves or other data sources for predictive patterns. Machine learning or “Artificial Intelligence” is not always involved in data-mining strategies. In fact the most popular – and surprisingly profitable – data mining method works without any fancy neural networks or support vector machines. Continue reading “Better Strategies 4: Machine Learning”

Build Better Strategies! Part 3: The Development Process

This is the third part of the Build Better Strategies series. In the previous part we’ve discussed the 10 most-exploited market inefficiencies and gave some examples of their trading strategies. In this part we’ll analyze the general process of developing a model-based trading system. As almost anything, you can do trading strategies in (at least) two different ways: There’s the ideal way, and there’s the real way. We begin with the ideal development process, broken down to 10 steps. Continue reading “Build Better Strategies! Part 3: The Development Process”

Build Better Strategies! Part 2: Model-Based Systems

Trading systems come in two flavors: model-based and data-mining. This article deals with model based strategies. Even when the basic algorithms are not complex, properly developing them has its difficulties and pitfalls (otherwise anyone would be doing it). A significant market inefficiency gives a system only a relatively small edge. Any little mistake can turn a winning strategy into a losing one. And you will not necessarily notice this in the backtest. Continue reading “Build Better Strategies! Part 2: Model-Based Systems”

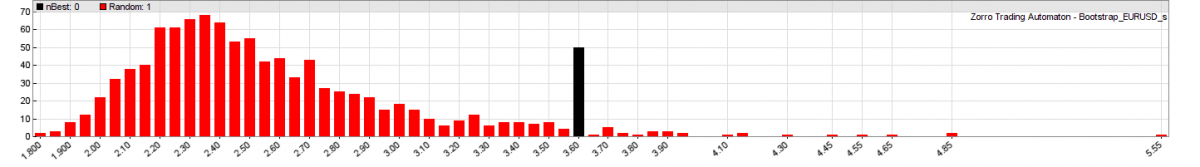

Better Tests with Oversampling

The more data you use for testing or training your strategy, the less bias will affect the test result and the more accurate will be the training. The problem: price data is always in short supply. Even shorter when you must put aside some part for out-of-sample tests. Extending the test or training period far into the past is not always a solution. The markets of the 1990s or 1980s were very different from today, so their price data can cause misleading results.

In this article I’ll describe a simple method to produce more trades for testing, training, and optimizing from the same amount of price data. The method is tested with a price action system based on data mining price patterns. Continue reading “Better Tests with Oversampling”

Build Better Strategies!

Enough blog posts, papers, and books deal with how to properly optimize and test trading systems. But there is little information about how to get to such a system in the first place. The described strategies often seem to have appeared out of thin air. Does a trading system require some sort of epiphany? Or is there a systematic approach to developing it?

This post is the first of a small series in which I’ll attempt a methodical way to build trading strategies. The first part deals with the two main methods of strategy development, with market hypotheses and with a Swiss Franc case study. Continue reading “Build Better Strategies!”

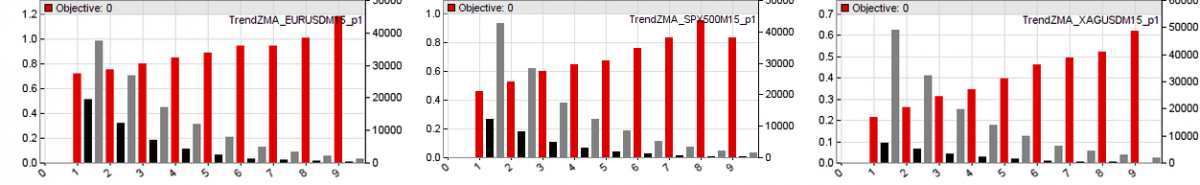

Boosting Strategies with MMI

We will now repeat our experiment with the 900 trend trading strategies, but this time with trades filtered by the Market Meanness Index. In our first experiment we found many profitable strategies, some even with high profit factors, but none of them passed White’s Reality Check. So they all would probably fail in real trading in spite of their great results in the backtest. This time we hope that the MMI improves most systems by filtering out trades in non-trending market situations. Continue reading “Boosting Strategies with MMI”

The Trend Experiment

This is the second part of the trend experiment article series, involving 900 systems and 10 different “smoothing” or “low-lag” indicators for finding out if trend really exists and can be exploited by a simple algorithmic system. When you do such an experiment, you have normally some expectations about the outcome, such as: Continue reading “The Trend Experiment”