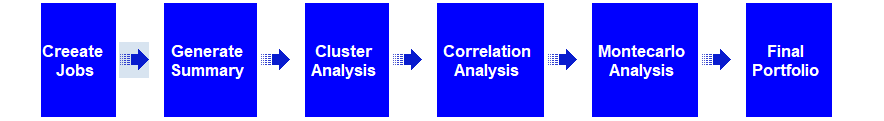

Developing a successful strategy is a process with many steps, described in the Build Better Strategies article series. At some point you have coded a first, raw version of the strategy. At that stage you’re usually experimenting with different functions for market detection or trade signals. The problem: How can you determine which indicator, filter, or machine learning method works best with which markets and which time frames? Manually testing all combinations is very time consuming, close to impossible. Here’s a way to run that process automated with a single mouse click. Continue reading “Build Better Strategies, Part 6: Evaluation”

Category: No Math

Pimp your performance with key figures

Not all scripts we’re hired to write are trading strategies. Some are for data analysis or event prediction – for instance: Write me a script that calculates the likeliness of a stock market crash tomorrow. Some time ago a client ordered a script for improving the performance of their company. This remarkable script was very different to a trading system. Its algorithm can in fact improve companies, but also your personal performance. How does this work? Continue reading “Pimp your performance with key figures”

The Digital River Mystery

Digital River was a popular eCommerce service, used by thousands of developers and software companies worldwide to distribute their software. oP group Germany, developers of the Zorro platform, also sold their licenses and subscriptions through Digital River. They have large clients, such as nVidia and Adobe. The first hint that something strange was going on with Digital River was an email in July to their clients. Continue reading “The Digital River Mystery”

Better Indicators with Windowing

If indicators didn’t help your trading so far, just pimp them by preprocessing their input data. John Ehlers proposed in his TASC September article the windowing technique: multiply the input data with an array of factors. Let’s see how triangle, Hamming, and Hann factor arrays can improve the SMA indicator.

Monetize Alternative Facts!

After last week’s events, major social media companies made another attempt at saving humanity. Twitter and Facebook booted Trump and some of his enablers, Google and Apple cancelled Parler. But is censorship the right way to stem the swell of disinformation, postfactuality, dislocation from reality? I think not. Here’s a better solution. And you can even use it to earn some extra dollars. Continue reading “Monetize Alternative Facts!”

Petra on Programming: Short-Term Candle Patterns

Japanese rice merchants invented candle patterns in the eighteenth century. Some traders believe that those patterns are still valid today. But alas, it seems no one yet got rich with them. Still, trading book authors are all the time praising patterns and inventing new ones, in hope to find one pattern that is really superior to randomly entering positions. In the Stocks & Commodities January 2021 issue, Perry Kaufman presented several new candle patterns. Let’s repeat his pattern tests with major US stocks and indices, and with or without an additional trend filter. Continue reading “Petra on Programming: Short-Term Candle Patterns”

“Please Send Me a Trading System!”

“It should produce 150 pips per week. With the best EAs and indicators that you know. How much does it cost? Please also send live histories of your top systems.”

Although we often get such requests, we still don’t know the best indicators, don’t believe in best EAs, and don’t sell top systems. We do not sell algo trading systems at all, but only program them for clients after their specifications. We do not trade them, except for testing. But after programming almost 1000 systems, we can see a pattern emerging. Which trading strategies do usually work? Which will fall apart already in the backtest? Here’s a ranking of all systems we did so far, with a surprising winner. Continue reading ““Please Send Me a Trading System!””

Petra on Programming: The Gann Hi-Lo Activator

Fortunately I could write this article without putting my witch hat on. Despite its name, the ‘Gann Hi-Lo Activator’ was not invented by the famous esotericist, but by Robert Krausz in a 1998 article in the Stocks&Commodities magazine. In a recent article, Barbara Star combined it with other indicators for a swing trading system. Will an indicator with the name ‘Gann’ work outside the realm of the supernatural? Continue reading “Petra on Programming: The Gann Hi-Lo Activator”

Petra on Programming: The Compare Price Momentum Oscillator

Vitali Apirine, inventor of the OBVM indicator, presented another new tool for believers in technical analysis. His new Compare Price Momentum Oscillator (CPMO), described in the Stocks & Commodities August 2020 issue, is based on the Price Momentum Oscillator (PMO) by Carl Swenlin. Yet another indicator with an impressive name. But has it any use? Continue reading “Petra on Programming: The Compare Price Momentum Oscillator”

Petra on Programming: Truncated Indicators

Cumulative indicators, such as the EMA or the MACD, are affected by a theoretically infinite history of candles. In finite backtests, these indicators return slightly different results depending on the test period. This effect is often assumed negligible. But John Ehlers demonstrated in his July S&C article that it is not so. At least not for some indicators, such as a narrow bandpass filter. We have to truncate the indicator’s ‘internal history’ for getting consistent results. How do we do that in C? Continue reading “Petra on Programming: Truncated Indicators”